Product management survey 2024 summary

We conducted a comprehensive survey among product people in Estonia at the beginning of June. It is time to look at the results and analyze what interesting insights can be drawn from the answers.

A total of 54 people involved in product management responded to the survey, which is a very good result for the first time. Respondents came from companies of various sizes and had a wide range of experience in product management.

Thank you to everyone who responded to the survey.

Overview of respondent profile

Answerer job title

85% of the respondents were either product managers, product owners or product domain leaders.

We colleration that senior job titles are more common in smaller teams.

Company type

The majority (80%) work for companies providing their own products, with a few (11%) from consultancy service providers. We had only 4 answers from the governmental agency and 2 answers from software development outsourcing companies.

Company maturity

Almost half of the companies are already mature – being operating more than 10 years on the market.

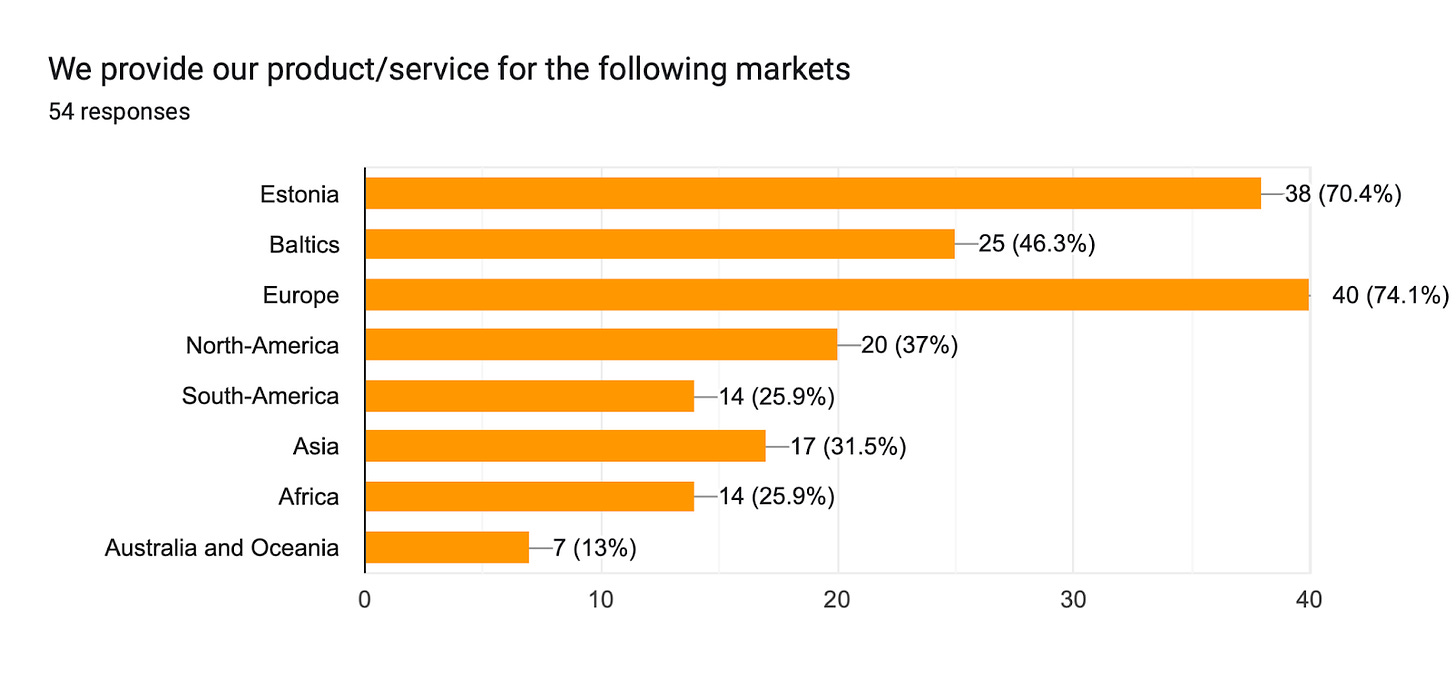

Market reach

Most of the companies serve multiple markets, including Estonia, the Baltics, Europe, North America, and beyond.

If we look at companies operating only in the Estonian market, government agencies and early-stage companies stand out.

Product team size

Employees from companies of various product team sizes participated in the survey, and we can say that the full spectrum is fairly evenly represented.

Challenges product managers are facing

One of the standout points from the survey was the diverse range of challenges faced by product managers. Some of the most frequently mentioned challenges included:

Aligning with company goals: Ensuring that the product strategy aligns with the company's overarching goals and OKRs is a significant hurdle.

Effective user research: Conducting thorough and regular user research to gather actionable insights.

Prioritization and roadmapping: Developing and maintaining a clear, documented roadmap that is regularly reviewed and communicated to stakeholders.

Product strategy

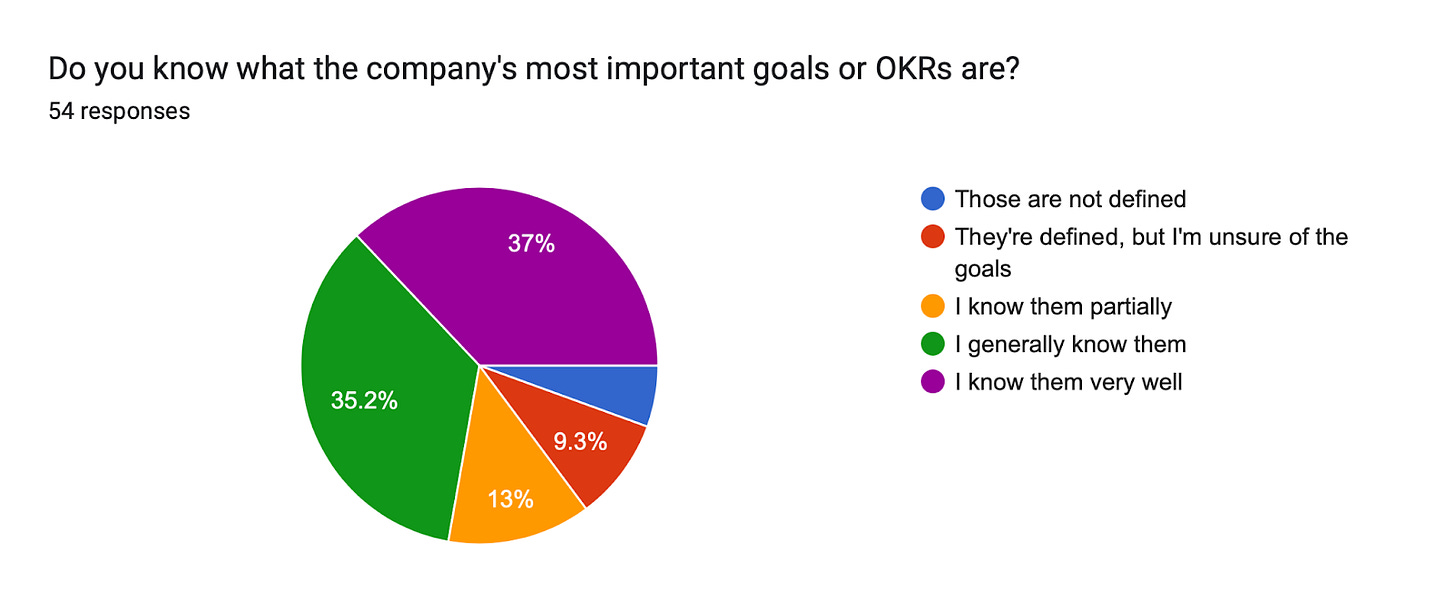

Goals alignment

From the answers to this question, it can be concluded that, in general, companies are quite good at setting goals. Clear goals are mostly in place, and product managers are also well aware of them. Two-thirds of the respondents said they know the goals very well or at a general level.

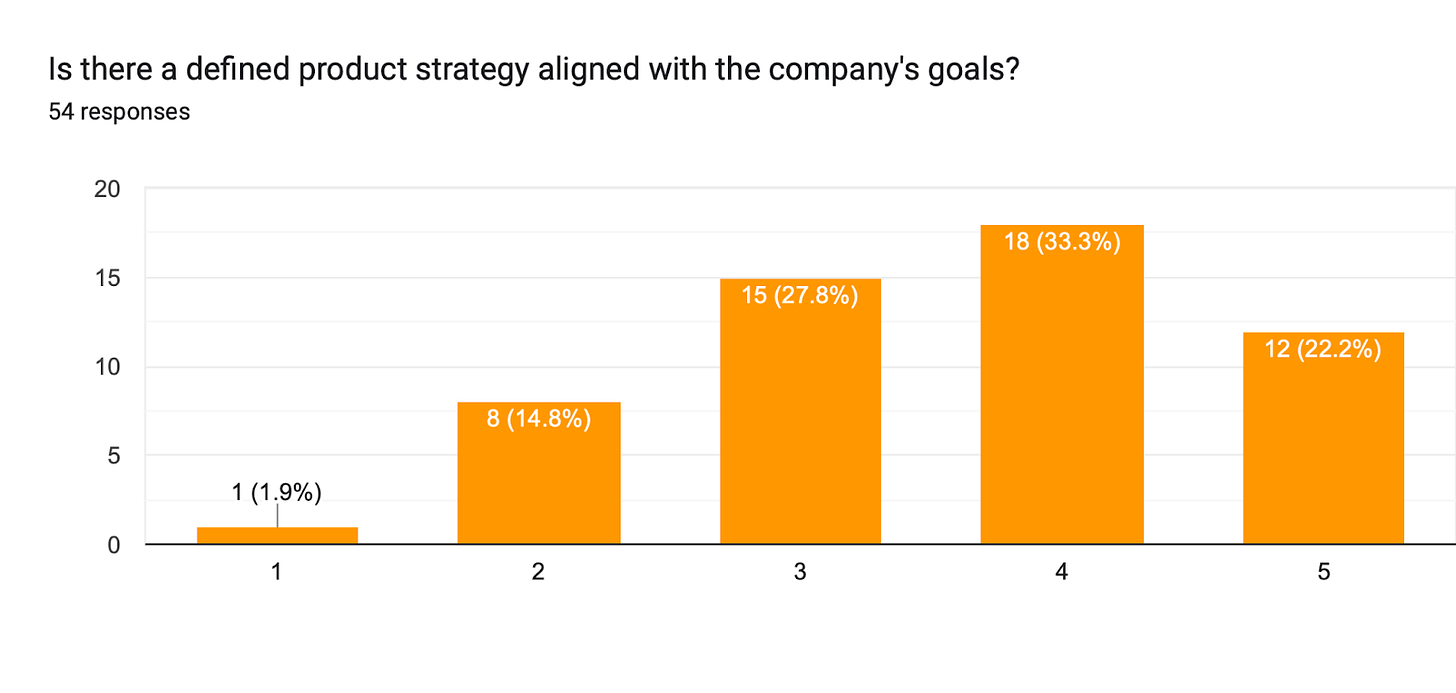

Most product managers also responded that the product strategy tends to align with the company's business goals.

We see that teams struggling to align product strategy with company goals tend to use feature-based roadmaps, and most of them do not have cross-functional teams in place. They also indicate that information is not well-shared between the product team and other teams.

Roadmaps

We see that roadmaps are widely used in product management, and the responses suggest that feature-based roadmaps are still the most common. However, there is a 15% outcome-based roadmaps. What I find interesting is that the predominant approach is a combination of both – I think this indicates a shift towards outcome-based roadmaps.

If we look at what connects those respondents who say they do not use roadmaps, all of them have more than 10 years of experience in product management and are mostly from early-stage companies.

We see that roadmaps are common tools among product teams. Typically, they are reviewed quarterly, but some companies review their roadmaps more frequently.

Market and User Research

The answers to this question were the most interesting - when looking at the frequency of user research, only one-third of the respondents conducted it either monthly or weekly. As a product manager, I would like to delve deeper to understand why local product managers pay so little attention to user research. In modern product management practices, the common recommendation is that customer interviews should take place weekly.

Larger product teams tend to conduct user research more frequently, which is also quite an expected result, as they do have more resources to use.

Regarding the methods used, the most common is the qualitative customer interview (82%), followed by quantitative surveys (74%) and monitoring customer support channels (52%).

In the forth place is information from review sites (44%) and using third party market research (24%).

Product Planning and Development

The main sources for prioritization are the company's strategic goals (89%) and customer requests (67%). In third place, we found prioritization based on data analysis and conducted experiments (52%). For a third of the respondents, the "good" old HiPPO-based prioritization is also common.

One of the strong features of an agile team is the ability to frequently release changes and continuously and quickly learn from the product environment's feedback loop. Therefore, it is good to see that nearly half of the companies are able to release updates weekly or even daily. About a third of the companies have opted for a monthly release cycle.

We did not find any correlation that larger or smaller companies release more frequently.

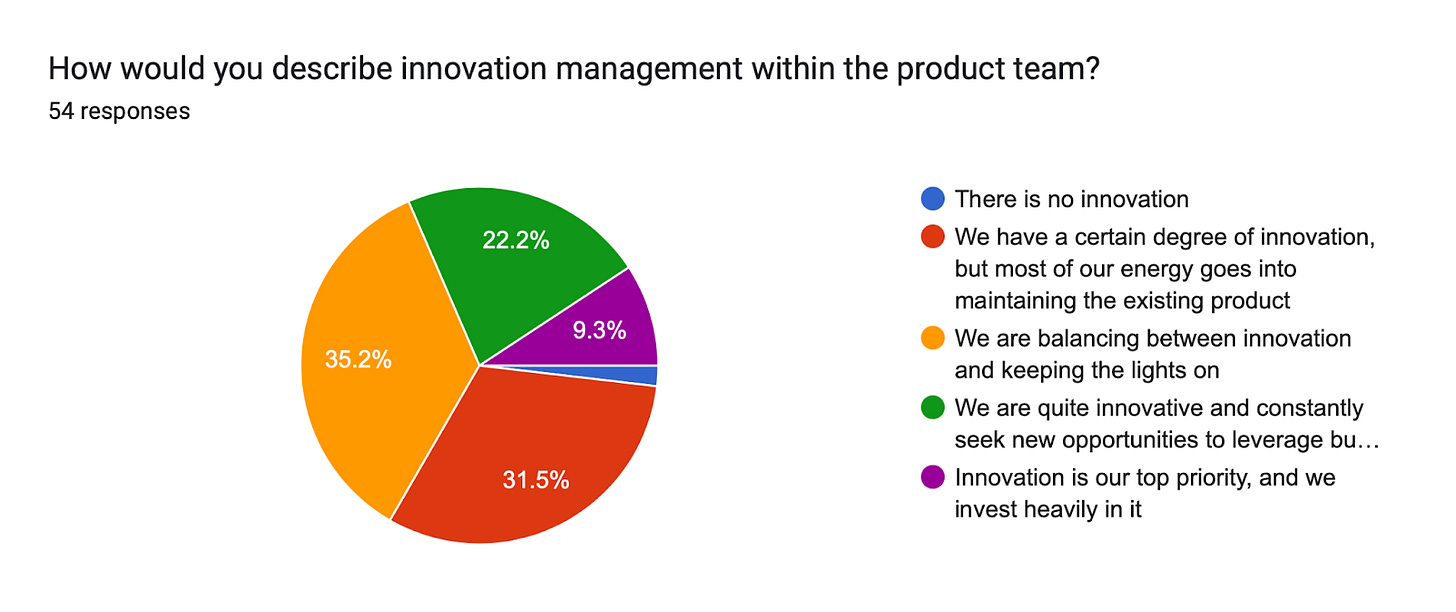

Innovation management

Most companies try to find a balance between innovation and maintaining existing business operations.

There is more focus on innovation in smaller and younger companies, which is understandable since they have less legacy and spend less energy on maintaining existing business operations, allowing them to focus more on innovation. Managing innovation in companies is an interesting topic. I plan to write more about it in a separate post. There, I will look deeper into the data from this survey and try to find different additional correlations.

Collaboration and communication

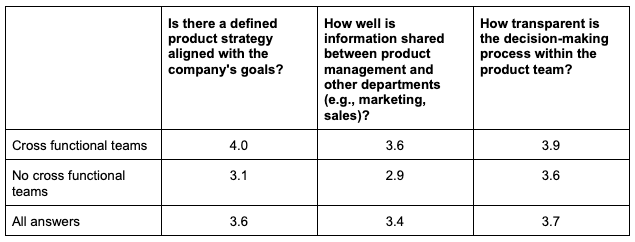

In more than half of the respondent companies, cross-functional product teams are in use. In companies where cross-functional teams are absent, the product teams tend to be smaller.

I am a strong believer in cross-functional teams, and when we look at these responses, we see that companies with cross-functional teams have significantly higher alignment with business goals. Additionally, these companies rate information flow between teams much better. There is only little positive impact to the decision making process transparency. We could be biased as the responses are mainly from PMs but we'd need to keep our eyes open to the answer changing if we had all other functions answer it.

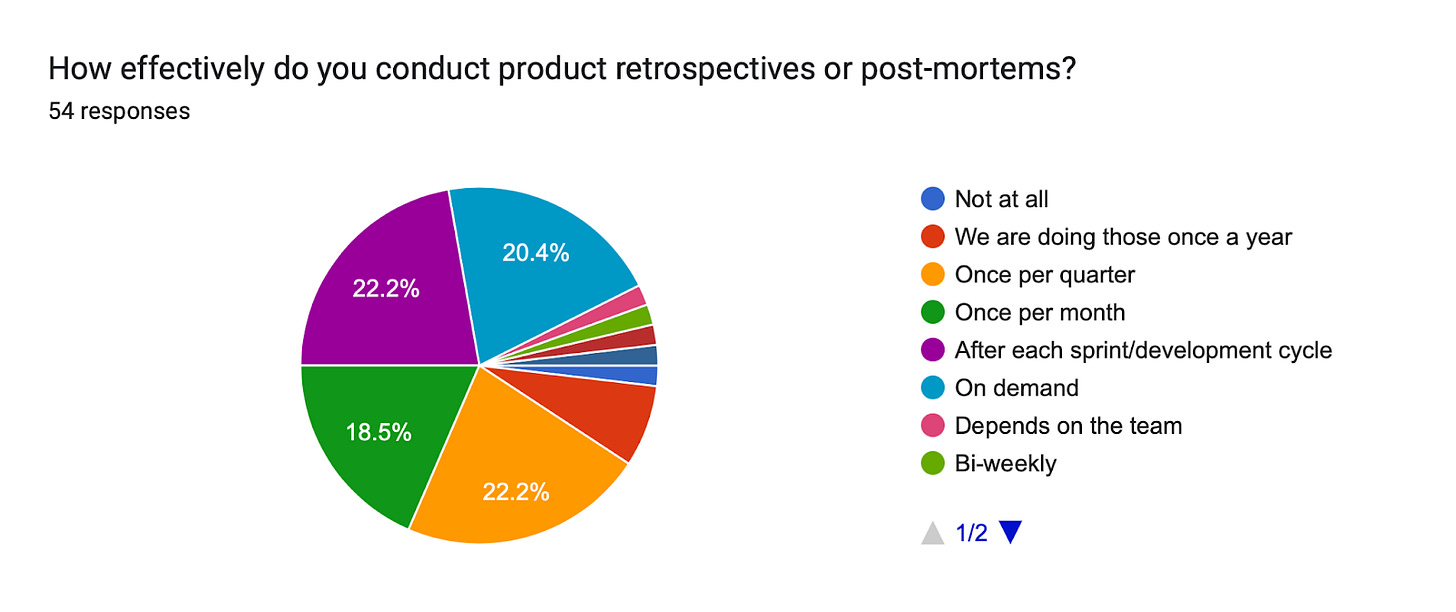

It is nice to see that conducting retrospectives has become an established practice in Estonian organizations. In most companies, this is done regularly.

Metrics and performance

As the last topic on product management practices, we examined the extent to which product management metrics are used. The responses indicate that only a quarter of the respondents felt they have well-defined metrics. The majority found that their metrics are partially defined, and a tenth do not use metrics at all.

When we look at how often metrics are worked with, the intervals mentioned are surprisingly infrequent. As many as one-third of the respondents found that they analyze metrics rarely, and ~40% pay attention to metric analysis on a monthly basis.

Product metric

The most important product metrics tracked include customer acquisition and onboarding metrics like conversion rate, customer retention and engagement metrics like churn and retention rates, and revenue metrics such as MRR and profitability. User feedback metrics like NPS and CSAT are also quite often monitored. Companies emphasize a mix of quantitative and qualitative metrics to balance user satisfaction and financial performance. Some organizations are still in the process of setting up or refining their metrics systems.

About 10% of the total responses focus exclusively on financial metrics (e.g., revenue, profit, transaction amounts, monetisation metrics, GMV, profitability).

We see that older companies might have more diverse and specific metrics, likely due to more established processes and goals. Conversely, newer companies focus on fundamental growth and engagement metrics.

~10% indicated that they do not have any metrics in place.

Some final words

Thank you very much to all the respondents! To get the most benefit from the survey for the product managers community, we will publish all the responses received. Both the results file in Google Forms PDF export and the raw data in Google Sheets will be accessible.

It would be exciting to hear what interesting insights can be drawn in addition to the ones I have provided. I believe there are many product managers who are much more experienced in data analysis than I am.

Until next year! Although organizing this survey and analyzing the responses was relatively time consuming, I believe the effort is worth it and I plan to repeat the same process in about a year.