How to launch 0 to 1?

Insights from the founder of Copilot2Trip, Islam Midov. What to build? Why Founder market fit matter? Why AI? How to sell? What is the next stage?

Hey👋 Nikolay Roll from Tallinn Product Group here.

This article brings insights from Islam Midov, an ex-consultant, VC investor, and founder of Copilot2Trip — an AI-driven travel assistant that creates personalized travel plans with interactive maps.

Midov began his startup journey in 2023 after leading MTS’s corporate venture fund for four years. By the time Copilot2Trip was sold, it had a monthly active user base of 40,000.

In this article:

Problems with “0 to 1”. 2 key problems that founders face at the “0 to 1” stage.

How to find a product idea? Why does Founder-Market Fit matter? How do changes in technology help?

How to sell your product? What to consider when evaluating your acquisition channels and exploring available marketing channels.

Going beyond 0 to 1. What’s next?

📖 Word count: ~2800

⌛ Time to read: ~12 min

1. Problems with “0 to 1”

Launching “0 to 1” means finding product-market fit (PMF) — creating a product or service that is entirely new and unique.

Many startup founders strive to achieve PMF and grow their startups beyond this initial phase. It’s often considered the toughest and most creative challenge in entrepreneurship. However, once it is achieved, it paves the way for scaling from 1 to n.

First-time founders tend to focus on the product, while second-time founders prioritize distribution.

When thinking about a startup, there are two key questions a founder must answer:

How to find a product idea?

How to sell your product?

The first problem is often deemed easier to solve, while the second is perceived as more challenging.

This challenge is compounded by competition. Many markets are already dominated by established tech giants, and these incumbents are not willing to give up their market share easily.

As Sequoia notes in “Generative AI’s Act 1”: “The classic battle between startups and incumbents is a horse race between startups building distribution and incumbents building products. Can the young companies with cool products get to a bunch of customers before the incumbents who own the customers come up with cool products?”

You can find incumbents in nearly every market you examine:

Flight booking = Skyscanner

Hotel booking = Booking.com

Search = Google

Phones = Apple/Samsung

Social Media = Instagram/TikTok, etc.

Each market has its own monopolies or oligopolies.

Islam Midov describes: “While building Copilot2Trip, hundreds of other similar apps were launching simultaneously. We weren’t afraid of them. The real challenge was competing with Booking.com.

They dominated SEO, one of the few reliable acquisition channels. They also maintained exclusivity agreements with numerous hotel chains (meaning these hotels were only available on Booking.com). Additionally, many companies and individuals already trusted Booking.com.

This led to three key advantages for the incumbent: acquisition channels, inventory (hotels), and customer trust. The barriers to entry were extremely high.

On top of this, Booking.com is a technologically advanced company. They launched a similar product to Copilot2Trip. While their product was inferior, it was integrated with their other offerings, making competition far more difficult.”

For new entrants, this can feel demotivating, as it seems nearly impossible to break into a market already controlled by existing players.

This raises the question: “How do you build a superior product and capture a share of the market?” Is it even possible?

2. How to find a product idea?

South Park Commons discusses the concept of a stage called “-1 to 0” that comes before even starting a company. This is the phase where you’re still figuring out what kind of business you want to build.

During this stage, many aspiring founders are still working regular jobs or are occupied with other projects. The key question they grapple with isn’t merely what they could do, but what they should do.

Why focus on what you “should do”? Because of “Founder-Market Fit.” This concept revolves around having the right background and experience to deeply understand your industry. If you’re already well-versed in a particular field, you have a head start. It can save you years of learning the basics and figuring out what does and doesn’t work.

“I started by learning a lot about tourism. I’ve traveled to over 30 countries as a digital nomad, so I’ve personally experienced many of the problems travelers face.

Additionally, I worked in venture capital, engaging with both large corporations and small startups in the travel sector. I gained insights into what they prioritized, their struggles, and what drove them.

All of this gave me a strong understanding of what’s important for businesses and customers in the travel industry. I developed a deep knowledge of B2C travel and also acquired a solid grasp of B2B aspects.

This led to experimentation and pivots in the travel space, ultimately culminating in the creation of Copilot2Trip.”

📱Technology change = opportunity

The wider adoption of the internet marked a major technological shift, enabling many things that were previously impossible — from online communication to ordering taxis with just a few taps.

“For many founders, there’s a common question: ‘Why now?’ In most cases, the answer lies in technological change, which makes it viable to revisit and innovate within existing markets using new technologies. I personally skipped the Crypto and VR waves and decided to hop onto the AI wave.”

This explains, in part, why there are so many AI startups today.

However, this wave of technological change is different from previous ones. In the past, slow-moving giants often delayed implementing new technologies until it was too late — think “Kodak and the digital revolution.”

Historically, the gap between the introduction of a new technology and when incumbents adopted it was often long enough for startups to carve out market share.

The current wave is different. Tech giants are now quick to adopt and integrate AI tools (e.g., OpenAI API, Gemini API, Claude API, and more) into their products.

This makes life harder for newcomers, as they can no longer rely solely on a “time-to-market” advantage. It’s no longer sufficient to have just a good product — they need a great product to compete.

🧑💻Building a difficult product

General tools like ChatGPT struggle with nuanced areas such as legal or healthcare because the price of mistakes in these fields is extremely high. As a result, more tailored, domain-specific tools are likely to outperform general or broad AI solutions.

For example, many companies are focused on building copilots — whether for search (e.g., Perplexity) or coding (e.g., GitHub Copilot). Building a copilot is relatively easier, which is why we see new copilots for programming launching almost every month.

On the opposite end of the spectrum, consider autonomous vehicles. Developing a self-driving car is a complex challenge. It requires vast amounts of training data, models capable of operating the vehicle, and even manufacturing the cars themselves.

While it may not be a perfect comparison, as business models differ and it’s much easier to sell a $20 subscription for a copilot than to sell a car, the point stands: differentiation is easier to achieve when tackling more complex problems.

For this reason, Founder-Market Fit (FMF) has become increasingly critical. If you have FMF, you possess deeper insights into opportunities within your industry due to:

Years of experience in a specific domain

Understanding of the problem space

Relevant network and technological know-how within the market

“Switching to a new industry is challenging and can take years. It’s highly likely that my next startup idea will be in an area where I already have prior experience.”

We highly recommends to read the article by South Park Commons on topic of “-1 to 0” and Sequoia’s “Generative AI’s Act o1”

3. How to sell your product?

Product distribution is a major challenge. Many startups fail because they cannot find effective channels to reach their ICP. It makes sense to evaluate your acquisition channels through the lens of your Unit Economics.

In short, Unit economics is “how much we earn and spend per user or other unit”. For example, founders of Copilot2Trip looked at Average Revenue Per User (ARPU) and Customer Acquisition Cost (CAC).

📈 Acquisition channels

Below, we outline some of the channels with comments from Islam Midov on how they performed while building Copilot2Trip.

“We understood that our product, Copilot2Trip, had a low ARPU because the problem it solved was not a frequent one. Therefore, our acquisition channels needed to be either cheap or free.”

First, let’s cover the channels that mostly did not work:

❌ Paid ads in Socials

Platforms such as Facebook, Instagram, TikTok, Reddit, etc. — launching paid ads on these platforms did not yield good results. The unit economics simply did not align. Customer Acquisition Cost (CAC) was too high, and the incoming traffic had poor conversion rates. It was too expensive to continue experimenting with this channel.

❌ Search ads

This was an interesting option. Theoretically, if you have a strong product with high conversion rates, you can try to outbid the incumbent in search results.

However, do you have good conversion rates in the beginning? Likely not. Achieving good conversion requires traffic to validate your funnel, but attracting traffic also costs money. It becomes a loop of attracting traffic and validating conversions, which can be prohibitively expensive for early-stage startups and drain their resources quickly.

❌ Influencers

This channel only works well if you can go viral. However, consistent virality with influencers is difficult to achieve. Since it’s a paid channel, it’s also not sustainable in the long run.

Now, let’s move on to what worked:

✅ Virality

“Virality was our main channel. It is the main channel such products should leverage.”

Why Virality? It rapidly expands reach and attracts high volumes of traffic. For example, with Copilot2Trip, users often shared their app-generated search results and other content, which naturally drew in new users.

“The key point for selling such a product is the ‘wow’ effect. Virality can be achieved when users are unfamiliar with the product.

Virality = Product competitive advantage or uniqueness * pain size.

We experienced virality up until competitors launched similar products, at which point it lost its novelty.”

While virality is a powerful source of traffic, it can be temporary, as a product’s uniqueness diminishes once similar offerings emerge.

✅ Content marketing and SEO

SEO’s goal was to generate consistent and lasting traffic by creating unique content and optimising search visibility.

However, even this approach has its challenges:

It takes considerable time to actually show up in the search results.

Competition can be intense.

It’s an organic channel, meaning its success depends on search engines (like Google) showing your content in search results. Whether you appear depends heavily on “domain authority”, which, in turn, depends on “backlinking” (the number of sites referring to your content). Building domain authority is a function of time.

“SEO is the primary channel for travel businesses. It drives most of the traffic.

The longer you are in the market, the more backlinks you have. The bigger you are, the more people refer to you.

This is the advantage of established players, which makes competing with them incredibly challenging.

For that reason we focused more on virality.”

If you can commit to creating high-quality content consistently, you may gain sustainable traffic. However, competition for popular search terms can be fierce.

Success depends on “how well you solve the problem,” which often translates to having high-quality, unique content. For example, appearing in search results for terms like “3 days in Paris” is incredibly difficult for newcomers. Consistently creating niche content and optimizing your SEO will help you build sustainable traffic — but only over time.

✅ Listings

This involves listing your product on aggregators for travel apps or platforms such as Product Hunt. Copilot2Trip, for example, was recognized as “Product of the Day,” which drove traffic from the platform.

“There were numerous catalogs, including ones specifically for AI products (some paid, some free). These brought us many users initially and continued to be a stable source of traffic even until the end.”

👉 Which channel to pick?

Overall, there is no silver bullet for product distribution. It makes sense to test various channels and see which ones work for you and your Ideal Customer Profile (ICP).

“It’s clear that you need to know your ICP and choose acquisition channels accordingly. For us, we identified our ICP as travelers who have a few days in a city and need a planner to help organize their trip.

However, given our unit economics, we realized that the specific ICP didn’t matter as much. There’s a story from Square’s marketing team about how they selected user segments based solely on Facebook filters.

The point is that it doesn’t matter what segments you come up with unless you can effectively target them.

With our unit economics, we knew we were limited in how we could reach our users. So, we tried everything.

In hindsight, if we had more resources, we might have spent more on ads. But part of me is glad that we didn’t, because ads don’t work well for many startups. The unit economics just don’t align for newcomers.”

Another consideration is how to market and sell to B2B and Enterprise customers. Many of the channels mentioned above, such as content marketing, do work for B2B. However, when it comes to Enterprise sales, it’s a different game entirely. “People trust people.” Enterprise sales are heavily driven by relationships, and networking is crucial. There isn’t much more to add here.

At the end of the day, our marketing efforts boiled down to three main points:

Create unique and viral content to drive traffic to your landing page. Whether you’re targeting B2C or B2B customers, nowadays you need a solid content marketing strategy. Content marketing has proven to be one of the few reliable strategies for attracting free or inexpensive traffic.

Improve SEO for your landing page and content to bring in more traffic.

Optimize the landing page for conversions by enhancing the UX to “capture” paying users from the incoming traffic.

4. Going beyond 0 to 1

The end of the “0 to 1” phase means that you have achieved Product-Market Fit (PMF), gained an understanding of how to acquire users, and know how to grow your business. The next step is to scale up, or refer to it as “1 to n” (one to many).

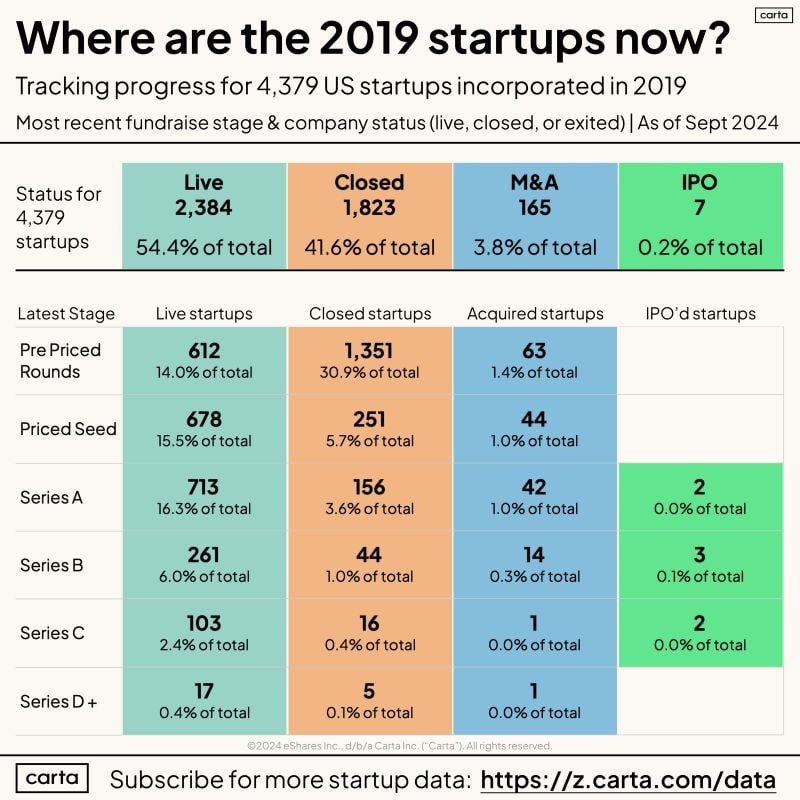

“IPOs are very popular, and it’s easy to see why. People love reading about IPOs. They’re attractive and fascinating — Netflix might even make a movie about an IPO. But in reality, there are far fewer IPOs than M&A deals.”

Many aspiring founders become fixated on the notion that they must build a billion-dollar company; otherwise, starting it seems pointless. Right? The reality is far more nuanced.

We’ve all heard that “9 out of 10 startups fail.” But this doesn’t mean “1 out of 10 becomes a unicorn/IPO/anything.” In truth, M&A deals are far more common, and there are even more startups that never achieve significant milestones.

To sum it up, there are 3 main paths to consider moving forward:

Build a billion-dollar company (unicorn/IPO/etc.)

Build a business that generates cash flow for its founders and potentially investors

Build a startup with the goal of M&A (mergers and acquisitions)

The first path is widely understood: achieve PMF, secure VC funding, scale rapidly, capture market share, aim for an IPO, and continue growing. Key metrics here include acquisition, engagement, and retention.

The second path is also clear: achieve PMF, perhaps obtain some funding, and focus on moderate growth with an emphasis on revenue and profit — as this is what founders and investors ultimately take home. However, metrics like acquisition, engagement, and retention are still essential.

The third path — M&A — is often overlooked. The goal here is to achieve traction and sell to a company that can benefit from your technology, market entry, or other assets.

“After several pivots, it became clear that Copilot2Trip had traction. However, it couldn’t thrive as a standalone business.

Further pivots would likely result in a small B2B business, but as a B2C concept, it was evident that it wasn’t self-sustainable.”

This path does not require rapid scaling or a robust standalone business model like the other paths. However, it still demands strong engagement numbers and delivering value — achieving PMF is essential.

Examples of such companies include:

Masquerade: In 2016, Facebook acquired Masquerade, a developer of real-time face-tracking and filter application technology, which had millions of downloads.

Bento.me: In June 2023, Linktree acquired Bento.me, a platform for creating personalized landing pages.

Gas: In January 2023, Discord acquired Gas, a social app for high school students focused on positive interactions, which had been downloaded over 5 million times.

You don’t have to choose your path at the start of your journey. But understanding your options can help you evaluate whether you have the resources and guide your next steps accordingly.

Summary

The “0 to 1” journey boils down to solving two key challenges: what to build and how to sell it.

Determining what to build involves navigating the “-1 to 0” phase (as described by South Park Commons) — a stage where you’re still deciding what kind of business you want to create.

It’s often more challenging to compete against established market incumbents than other startups.

Technological changes, such as AI, can open windows of opportunity, providing a chance to compete successfully with large corporations.

Having Founder-Market Fit (FMF) means understanding the market context deeply, which helps you identify valuable opportunities within the market’s problem space.

Focusing on more complex problems can offer a competitive advantage, often it comes from a strong FMF.

When considering how to sell your product, it’s crucial to focus on unit economics (e.g., ARPU vs. CAC).

Choose acquisition channels based on your unit economics, but be willing to experiment broadly to find what works best.

Finally, think ahead to the next stage — scaling up, or “1 to n.” Ask yourself: Do you want to grow into a large-scale company? Do you want to focus on building a “cash flow” business? Or should you consider a potential mergers and acquisitions (M&A) exit? This is a major strategic decision that depends on your vision, resources, and goals.

👋Nikolay here again.

Thank you, dear reader, for taking the time to read this article! A special thanks to Islam Midov for generously sharing his story.

Islam shared that he’s currently on the lookout for a new startup idea. Recently, he followed up with this:

“By the way, partly inspired by this conversation, I realized how much content I shared that I wouldn't have been able to express otherwise without a prepared interviewer. This made me think it’s a great way to create authentic content.

I went ahead and built an MVP: 2pr.io

It helps you grow your personal brand on LinkedIn with minimal time investment. You simply respond within 1-2 minutes using your voice to AI-generated questions tailored specifically for you. The AI then creates a post that captures your authentic style—something that would typically take 20-40 minutes to craft. Essentially, it functions as a LinkedIn copywriter on autopilot.”

Feel free to reach out to him with ideas or for feedback on his LinkedIn.

Re distribution channels: I see virality mentioned as one that works, but that is a combination of events and not a channel, right? So my assumption is that the content work done comebined with SEO generates, if things go well between right work and some luck, virality.

It's a classic scenario that building a product is easy, but finding paying customers for it is not so simple. For me, one of the biggest challenges is understanding where the problem lies when a certain channel isn't working—whether it's an issue with the channel itself, ICP profile, the messaging, or even the value proposition.

In my opinion, the 4Fits model aligns very well with this article: https://executivemind.ca/blog/four-fits-framework/